Here is the 2023 Sanibel, Captiva, and Southwest Florida Luxury Real Estate Market Report. Browse through the report to learn more about the Southwest Florida Luxury Real Estate Markert

2023 SWFL Luxury Market Report

Here is the 2023 Sanibel, Captiva, and Southwest Florida Luxury Real Estate Market Report. Browse through the report to learn more about the Southwest Florida Luxury Real Estate Markert

For over a year, the beloved Doc’s Beach House stood silent, a casualty of Hurricane Ian’s wrath. Walls crumbled, debris scattered, and the bottom floor became a mere shadow of its former self. But the spirit of this family-owned restaurant, a Bonita Springs staple since 1987, refused to be extinguished.

Through sheer determination and unwavering resilience, Doc’s Beach House has risen from the ashes, reclaiming its place on the pristine Gulf Coast beach. While repairs were underway, the passionate owners kept the flame of their culinary magic alive through a dedicated food truck, ensuring their loyal patrons wouldn’t go hungry.

Now, the wait is finally over! Doc’s Beach House is back, and bigger and better than ever. A soft opening on December 1st gave a taste of what was to come, and now, the grand opening on Friday throws open the doors to the public, inviting all to rediscover the magic of this iconic restaurant.

Step into Doc’s Beach House and be greeted by breathtaking views of the turquoise waters and the soft, golden sands. Savor delicious food prepared with love and expertise, knowing that each bite contributes to the ongoing revitalization of this cherished community treasure.

Head over to Doc’s Beach House at 27908 Hickory Blvd., Bonita Springs, and experience the perfect blend of exquisite food, breathtaking scenery, and heartwarming community spirit. Or, visit their website for a sneak peek: [link to website].

Let’s raise a glass to the triumphant return of Doc’s Beach House, a testament to the power of perseverance and the enduring spirit of Bonita Springs!

Click here for more information

Florida Gov. Ron DeSantis awarded $338 million in state funding to communities impacted by Hurricane Ian to support long-term recovery efforts and resiliency.

These funds will be used to assist with ongoing hurricane repairs and recovery efforts for schools, sheriff’s offices, fire stations, parks and recreation centers, roads, wastewater treatment plants, beach renourishment, and will assist local governments with loss of revenue since the storm.

“My administration made a promise to cut through bureaucratic red tape and fill in gaps where federal funding ends for communities impacted by Hurricane Ian,” said DeSantis. “This $338 million in funding is going to make a difference as these communities are rebuilding.”

Funding highlights include:

The Hurricane Recovery Program was established to assist with gaps in hurricane repairs and recovery efforts to schools, sheriff’s offices, fire stations, parks and recreation centers, roads, wastewater treatment plants, beach renourishment, and much more. For updates and information on disaster recovery resources, go to FloridaDiaster.org.

Closed Sales

Closed sales for the 12-month period ending August 31, 2023 were down 25% from the preceding 12-months, from 31,726 to 23,941. The 1,945 sales posted for the month of August were down 2% when compared to August of 2022.

Listing Inventory / New Listings

As of August 31, 7,564 properties were available, up 40% from the same date last year and static compared to the prior month. New listings for the 12-month period ending August 31 were down 9% from the preceding 12-months, from 36,467 to 33,076. For the month of August, new listings were down 1% from the same period in 2022. 3.79 months of supply was posted as of August 31, up 85% from August 2022 when months of supply was an unusually low 2.05 months, and unchanged from July 2023.

Average Selling Price

The average selling price for the 12-month period through August 31 was $795,912, up 7% from the preceding 12-month period when the average selling price was $746,900.

Perspective

Closed sales during the month of August fared well, posting a 9% uptick over July and a mere 2% shortfall compared to August of last year. Offering welcomed additional options for buyers, new listings posted month-over-month and year-over-year increases, at 5% and 1%, respectively. However, due to the steady pace of sales, standing inventory remains low from a historical standpoint with 7,564 units on the market as of August 31st, up 40% of one year prior, but still well short of the 10,000+ that was typical for this time of year prior to the pandemic-induced buyer surge. Due to continued steady demand and a tight inventory that’s increased little in recent months, and in spite of interest rates having edged up, closed sales prices have continued to rise year-over-year, but at a slower rate than during the height of the market.

Click here for the full report

A 1031 exchange is a tax-deferred exchange that allows you to sell one investment property and use the proceeds to buy another investment property of equal or greater value. This can be a great way to grow your real estate portfolio without having to pay taxes on the capital gains from the sale of your first property.

Here are the steps on how to do a 1031 exchange:

If you follow these steps, you can successfully complete a 1031 exchange and defer the taxes on the capital gains from the sale of your first property.

Here are some additional tips for doing a 1031 exchange:

Conclusion

A 1031 exchange can be a great way to grow your real estate portfolio without having to pay taxes on the capital gains from the sale of your first property. However, it is important to understand the rules and to work with a qualified professional to ensure that the exchange is completed correctly.

As of today, August 4, 2023, there are still 44 days left in the 180-day window for completing a 1031 exchange. If you are considering a 1031 exchange, it is important to act quickly so that you do not miss the deadline.

Click here for more info

Real estate leader Robin Sheakley, president of Sibcy Cline Realtors, received a text from a friend in Ohio asking for help in buying a house in Sarasota. Coincidentally, Sheakley happened to be in Sarasota at the time and was attending a dinner party hosted by Michael Saunders, founder of Michael Saunders & Co. Sheakley and Saunders see this as an example of the continued flow of homebuyers to areas on the west coast of Florida, despite some signs of weakness in the overall real estate market. They, along with four other realty brokerage leaders from around the state and country, spoke about the real estate market during a media session on April 26 at The Ritz-Carlton in Sarasota. The leaders were in town for a conference hosted by The Realty Alliance, a network of elite real estate brokerages across North America. They discussed the state of their home markets, trends, and what they see happening in Florida.

Inventory

Robin Sheakley notes that her company’s transaction volume in Ohio has decreased by 35% in 2023 due to a severe shortage of inventory. The other panelists, including Stephen Baird, President and CEO of Baird & Warner in Chicago, also report struggling with inventory. Baird, whose company is the oldest independent family-owned real estate services company in the U.S. and the largest independent real estate brokerage in Illinois, says his firm’s listings of homes for sale are down 50%. Despite high demand, they are unable to sell due to the lack of available homes.

Florida Pipeline

Despite facing challenges in the real estate market, including inventory shortages, the executives on the panel agree that Florida remains a popular destination for homebuyers. Ron Howard of John R. Wood Properties in Naples notes that many buyers seek second homes or condos in Southwest Florida for the weather and active lifestyle. John Horning of Shorewest Realtors in Wisconsin reports seeing an increase in dual ownership, with clients keeping condos in Wisconsin and buying another in Naples or elsewhere in Florida. Stephen Baird of Baird & Warner in Chicago also sees this trend, but believes the national stories of people fleeing Chicago and Illinois are overblown. Nonetheless, he recently opened a Florida office in Naples due to demand from his agents. Michael Pappas of The Keyes Co. in Miami says that people from the Midwest tend to head to the west coast of Florida, while those from the Northeast prefer the east coast. Some buyers are even purchasing homes in Ave Maria, 90 miles west of Miami, and commuting to Miami-Dade or Broward counties due to crowding in South Florida.

Insurance

Despite reforms to the state’s insurance market, affordable insurance remains a challenge for some homebuyers. Michael Pappas, president of The Keyes Co., notes that 80% of his firm’s clients are insured by Citizens Property Insurance Corp. due to lack of coverage options. Pappas also gives an example of the high cost of insurance in Miami, where he is paying $85,000 for insurance on a $3.5 million home. Some South Florida buyers in the higher price range have even decided to forego insurance altogether, according to Pappas.

Mortgage Rates

Panelists are advising clients that low mortgage rates of 3% or 4% are unlikely to return. However, Michael Pappas notes that even the current fixed-rate of 7.1% is better than it has been for at least 40 of the past 50 years. Buyers are being informed that this is the new normal, but they can purchase now and refinance later if/when rates go down. As Elizabeth Sheakley says, “you date the rate, but you marry the house.”

Design

Real estate executives see a trend towards more space, including backyards, pool areas, and ceiling heights, as well as better use of space, such as sliding doors. They note that the Mediterranean look is out and modern style is in, and that the outdoor lifestyle is popular. Michael Saunders & Co. has 20 sales offices and over 600 agents in Sarasota, Manatee, and Charlotte counties.

Click here to the entire article

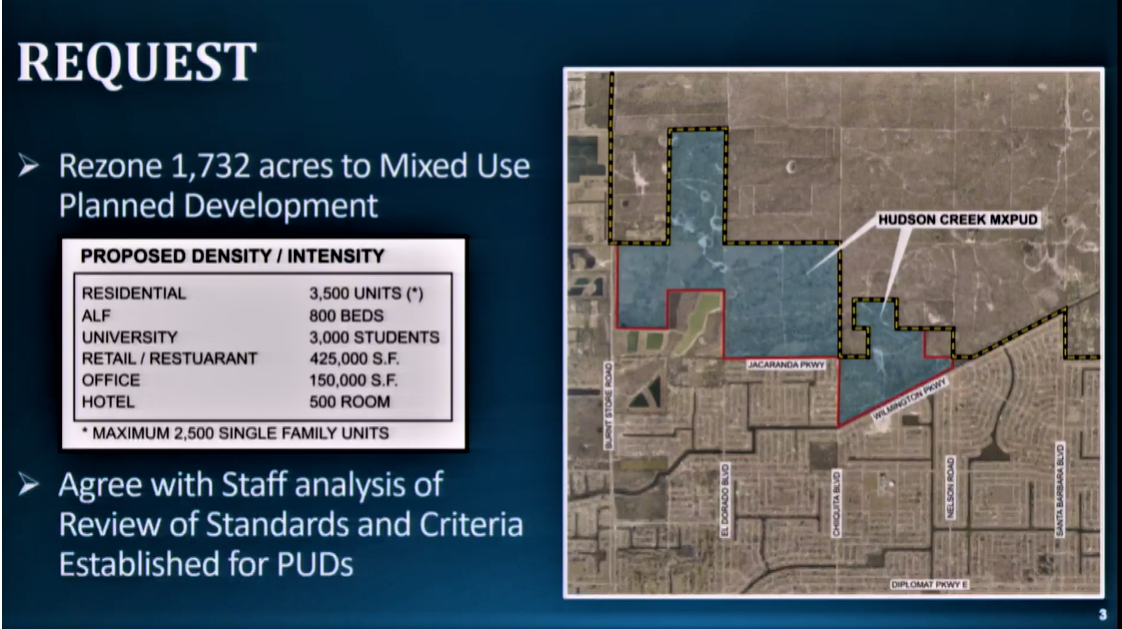

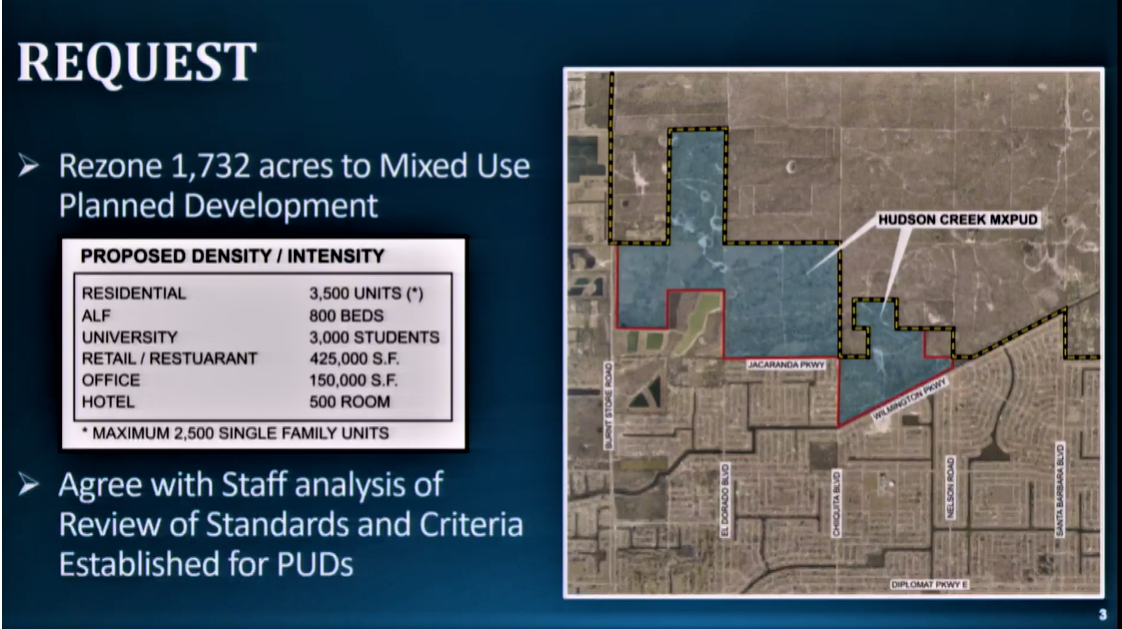

During a public hearing on Thursday, the Cape Coral City Council unanimously approved the Hudson Creek planned unit development, which encompasses a mixed-use area. This 1,732-acre development is located in northwest Cape Coral, positioned east of Burnt Store Road and north of Jacaranda Parkway.

The project will comprise up to 3,500 dwelling units, with 2,500 of these being single-family homes. Alongside the residential components, the development will feature 425,000 square feet of retail and restaurant space, 500 hotel rooms, and 150,000 square feet of office space.

Moreover, the site has been designated for a potential 800-bed assisted-living facility and a 3,000-student university, but no discussions have taken place with interested colleges or universities. The proposed schedule of uses serves as a guideline for permissible developments that can be established on the site.

Over the years, some sections of the site have been part of Cape Coral, while other portions were annexed into the city at different times.

The entire site remains undeveloped, with no existing roadway access and no utilities present.

A central spine road will be constructed through the development, with access from Burnt Store Road, Wilmington Parkway, Jacaranda Parkway, and Chiquita Boulevard. The neighborhood roads will feature sidewalks on both sides, and the spine road will have bike lanes on both sides as well. Click here for the entire article

Closed Sales

Closed sales for the 12-month period ending October 31, 2022 were down 27.28% from the preceding 12-months, from 40,710 to 29,606. The 1,454 sales posted for the month of October were down 40.24% when compared to October of 2021, a time when the market was still posting a record-breaking sales pace. Compared with pre-pandemic trends, October sales were down 21%.

Listing Inventory / New Listings

As of October 31, 2022, 5,215 properties were available, up 102.5% from one year prior and down 3% from the prior month. New listings for the 12-month period ending October 31, 2022 were down 6.54% from the preceding 12-months, from 37,318 to 34,876. For the month of October, new listings were down 33.5% from October of 2021. 2.11 months of supply was posted as of October 31, 2022, remaining well into a sellers’ market territory. In Southwest Florida, 6 to 12 months of supply is generally considered a balanced market.

Average Selling Price

The average selling price for the 12-month period through October 31, 2022 was $766,357, up 23.2% from the preceding 12-month period when the average selling price was $621,936.

Summary

While other parts of the country have posted increases in available inventory in recent months, inventory in Southwest Florida has posted three consecutive months of modest declines. This already-declining listing inventory was exacerbated by October’s particularly slow pace of new listings due to Hurricane Ian, down 33.5% from the same period last year and down 49% from the pre-pandemic pace. After a temporary disruption during the weeks just after Hurricane Ian made landfall, the rate at which listings have been going under contract for purchase has largely recovered and is now in line with the pre-storm pace. Newly pended sales are now trending with the pre-pandemic pace our market has been mirroring for much of the year. Hard hit areas such as Fort Myers Beach and the Islands will take more time before sales move back to their normal pace; however, sales are starting to pick up in those areas. Influenced by Hurricane Ian, year-over-year declines in closed sales for September and October were steeper than those for the preceding months, but recent increases in newly pended sales suggest that such steep year-over-year declines may be short-lived. We will continue to follow the various Southwest Florida markets closely and will keep you informed.

Click here for the full market report

Our Southwest Florida Market Report for September 2022 includes the latest real estate data, as well as a comprehensive list of market conditions in SWFL. From inventory and sales activity to market trends, it all comes together in this monthly market report. Stay up-to-date and plan ahead with our monthly market reports!

Closed Sales

Closed sales for the 12-month period ending September 30, 2022 were down 26.7% from the preceding 12-months, from 41,559 to 30,480. The 1,449 sales posted for the month of September were down 44.8% when compared to September of 2021, a time when the market was still posting a record-breaking sales pace. Compared with pre-pandemic trends, September sales were down 14%.

Listing Inventory / New Listings

As of September 30, 2022, 5,375 properties were available, up 108.5% from a year prior but down 1% from the prior month. New listings for the 12-month period ending September 30, 2022 were down 5.4% from the preceding 12-months, from 37,884 to 36,836. For the month of September, new listings were down 26.6% from September of 2021. 2.12 months of supply was posted as of September 30, 2022, remaining well into a sellers’ market territory. In Southwest Florida, 6 to 12 months of supply is generally considered a balanced market.

Average Selling Price

The average selling price for the 12-month period through September 30, 2022 was $755,403, up 22.6% from the preceding 12-month period when the average selling price was $615,992.

Perspective

Other than some end-of-the-month closings that no doubt were cancelled or postponed due to hurricane Ian, statistics as of our September report show little influence from the storm. In coming months, as more data filters through, we will be better positioned to assess the level of influence the storm has had on our local markets, and we will be certain to report those findings to you. Clearly, new listings and sales in the most impacted areas such as Fort Myers Beach and the Islands will post initial declines and lower than normal activity during the recovery process. If history is any indication, less impacted areas are likely to experience an increase in demand, both from displaced residents seeking housing, as well as from buyers who were targeting the now-impacted areas, and instead may seek alternative locations, at least until the most impacted areas recover.

What we can report so far for the market-at-large is that since Hurricane Ian passed, after newly pended sales fell sharply in the days following the storm, the rate of newly pended sales has increased steadily and, as of October 7th, daily sales were already back to 73% of their pre-storm pace. That’s for all Collier and Lee areas from Marco up to Cape Coral and the Islands. We are optimistic that overall market recovery will be swift, just as has proved to be the case in the past after other storms have impacted Southwest Florida. And yes, some specific areas will take longer, but those areas, too, will indeed recover and reemerge brighter and stronger when they do.

Hurricanes and Real Estate

Generally speaking, after a period of slower-than-usual sales, real estate markets usually recover at a surprising rate. This proved to be the case with Hurricane Irma which hit Southwest Florida in 2017. Newly pended sales dropped by 90% just following the storm, then were back to their normal pace just five weeks later. Reviewing what history suggests about how storm surge impacted markets recover; after Hurricane Katrina in 2005, sales in the Metro New Orleans market fell noticeably for about a month’s time before they returned to, and then even exceeded, their prior pace. More recently, after Hurricane Harvey in 2017, a similar trend held true for the Houston Metro area. Every storm is different and every market is different, and it remains to be seen exactly how recovery will look for Southwest Florida, but early indicators are favorable. Historical post-storm trends, a strong resolve by residents to rebuilt, and a continued deep passion for Southwest Florida’s beauty and lifestyle by residents and visitors alike, all bode very well for a strong recovery.

Click here for the full market report